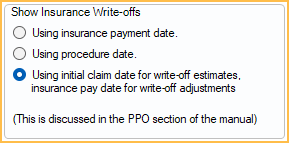

Show Insurance Write-offs

Offices can choose the default write-off option that best fits their practice needs when running reports.

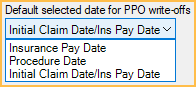

In Report Setup: Misc Settings, near the bottom, is a dropdown for Default selected date for PPO write-offs.

Choose the default setting that will affect the date write-offs will appear on reports. Insurance claims must be created before write-offs will appear on reports.

Reports

The option chosen in Report Setup will affect the default Show Insurance Write-offs setting for the following reports:

- Production and Income Reports

- Daily Write-off Report

- PPO Writeoffs Report

- Monthly Production Goal Report

- Custom Aging Report

The setting can be changed manually when running the reports.

Options

Insurance Pay Date: Use insurance payment date.

Apply write-offs when the insurance payment is received. Recommended when the write-off amount is unknown on the date of service (carrier fee schedule is unknown).

- Advantage: Historical reports will not be affected when the insurance payment (and write-off) is entered.

- Disadvantage: Net production (Tot Prod) for the day will not reflect the write-off. Instead, write-offs will be counted against production when the insurance payment is finalized. This may be very far after the actual procedure date.

This method is used in the patient Account Module. Use this method if the office uses global lock dates.

Procedure Date: Use procedure date.

Apply write-offs on the date the procedure is completed. Recommended when the write-off amount is known on the date of service (carrier's fee schedule has been entered).

- Advantage: Net production for the day will reflect the write-off (production subtracts write-off amount).

- Disadvantage: If the write-off amount is changed when the insurance payment is entered, historical reports need to be re-run.

- Before claim payments are finalized, reports will reflect write-off estimates. After claim payments are finalized, reports will reflect the final write-off. If the final write-off differs from the write-off estimate, this will only show when reports are re-run for the historical procedure date.

Initial Claim Date/Ins Pay Date: Use initial claim date for write-off estimates, insurance payment date for write-off adjustments.

On the claim date, the write-off estimate displays what was originally sent to insurance. Updating the write-off after the claim was sent will not reflect on the report under write off estimate but will display on reports as of the payment date under write-off adjustments once the payment has been finalized

- Advantage: Historical reports will not be affected when the insurance payment (and write-off) is entered. Allows paying providers on adjusted production when it's completed, and correct for any discrepancies in the future.

- Disadvantage: If the claim is created after the day of service, write-off estimates will show on a different date than the production; If the claim is deleted, the Claim Snapshot may not be accurate. Correction will occur when the claim is paid though a write-off adjustment.

- Uses the Claim Snapshot to determine write-off and write-off adjustments

- PPO Writeoffs Report Only: Both write-off estimates and write-off adjustments will be reported for the claim date. No write-off information will be reported for the insurance payment date.

This option is not available for Receivables Breakdown Report.