Coordination of Benefits ( COB )

Coordination of benefits (COB) rules determine how insurance pays when a patient has coverage under more than one plan.

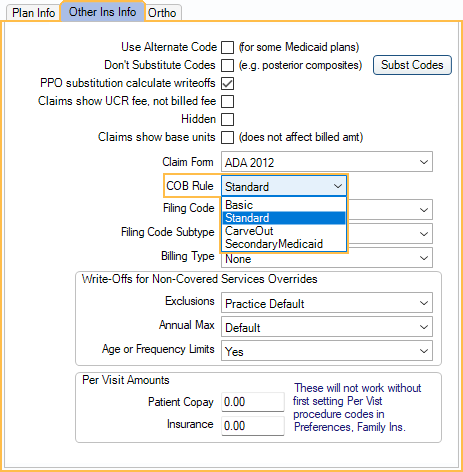

On the Secondary Insurance plan, in the Edit Insurance Plan window, Other Ins tab, select a Coordination of Benefits rule.

Set the default Coordination of Benefits rule in Preferences. There are many different ways to calculate COB, made even more complicated by various State laws. Non-duplication rules can vary, depending on the carrier.

Open Dental has the following different COB Rule options.

Basic: Secondary pays the lesser of:

- The amount that it would have paid in the absence of any other coverage.

- The secondary allowed amount minus what primary paid.

For example, on a $100 procedure, primary might pay $80 (80% of its allowed fee).

- If the secondary allowed amount was $110, secondary would pay the lesser of $88 or ($110 - $80), so $30.

- If the secondary allowed amount was $90, secondary would pay the lesser of $72 or ($90 - $80), so $10.

- As a second example, on a $100 procedure, primary might pay $50 (50% of its allowed fee).

- If the secondary allowed amount was $110, secondary would pay the lesser of $55 or ($110 - $50), so $55.

- If the secondary allowed amount was $90, secondary would pay the lesser of $45 or ($90 - $50), so $40.

Standard: Secondary pays the lesser of:

- The amount that it would have paid in the absence of any other coverage.

- The patient's portion for the primary plan.

For example, on a $100 procedure, primary might pay $80 (80% of its allowed fee).

- If the secondary allowed amount was $110, secondary would pay the lesser of $88 or $20, so $20.

- If the secondary allowed amount was $90, secondary would pay the lesser of $72 or $20, so $20.

- As a second example, on a $100 procedure, primary might pay $50 (50% of its allowed fee).

- If the secondary allowed amount was $110, secondary would pay the lesser of $55 or $50, so $50.

- If the secondary allowed amount was $90, secondary would pay the lesser of $45 or $50, so $45.

Carve Out: (Non-Duplication) Secondary reduces what they pay by what primary paid.

Calculation used: Secondary InsEst = (Secondary Allowed - Secondary Deductible) * Secondary Percentage - PaidOther

Example with deductible: On a $1500 procedure, primary might pay $750 (50% of its allowed fee).

- If secondary allowed amount was $1200, secondary deductible was $50 and secondary percentage was 80%, then secondary would pay: $170

- 170 = (1200 - 50) * .8 - 750

Example without deductible (Non-Duplication: On a $100 procedure, primary might pay $80 (80% of its allowed fee).

- If secondary allowed amount was $110, secondary would pay $88 - $80 = $8.

- If secondary allowed amount was $90, secondary would pay $72 - $80 = $0.

- As a second example, on a $100 procedure, primary might pay $50 (50% of its allowed fee).

- If secondary allowed amount was $110, secondary would pay $55 - $50 = $5.

- If secondary allowed amount was $90, secondary would pay $45 - $50 = $0.

Secondary Medicaid: Secondary reduces what they pay by what primary pays. The estimated patient portion becomes a write-off for the primary insurance. This rule is only considered when a plan is secondary (Order = 2). Additional plans (e.g., tertiary) use Standard COB logic. Only use this rule when allowed to bill Medicaid as secondary.

Calculations used: Pri Ins Write-Off = ProcFee - Pri Ins Pay Est (or Pri Ins Pay) - Sec Ins Est (or Sec Ins Pay)

Secondary Ins Est = (Secondary Allowed - Secondary Deductible) * Secondary Percentage - PaidOther

Examples: On a $100 procedure, primary insurance might allow $70, pay $35, and write off $30. Secondary insurance might allow $20, pay $0, and write off $35. The patient pays $0.

On a $100 procedure, primary insurance might allow $40, pay $20, and write off $60. Secondary insurance might allow $30, pay $10, and write off $10. The patient pays $0.