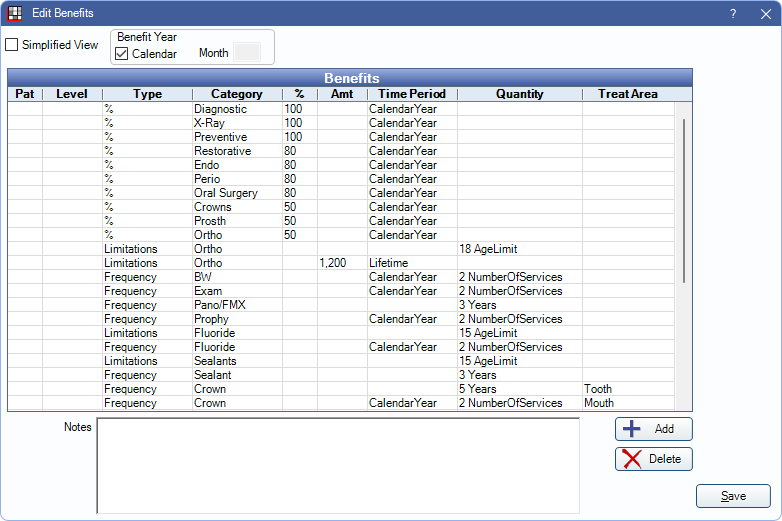

Edit Benefits - Row View

Use the Benefits Row view to view each benefit as a line item.

In the Edit Benefits window, uncheck the Simplified View box.

This is useful when typical Insurance Categories are not used (e.g., in a country other than the U.S. or Canada).

- Simplified View: Check/uncheck the box to switch between Simplified View and Row View.

- Benefit Year: See Simplified View for details. This area does not change when using Simplified or Row View.

- Benefits: Each row represents a benefit. Double-click to edit. See Edit Benefit.

- Add: Create a new insurance benefit. Opens the Edit Benefit window.

- Delete: Select an item in the grid and click to remove an existing insurance benefit.

- Notes: The same as subscriber notes on the Insurance Plan. Certain types of benefits are not easily codified and cannot be added as a benefit row. If the benefit affects this subsciber (and dependents), the benefit information can be entered here. These are informational only. Examples of benefits which get entered as notes are:

- Missing tooth exclusion (a clause that states that if a tooth was extracted before the patient became insured through them, that they will not cover any replacement teeth including a partial or a bridge).

- Wait on major treatment (usually 6 months to a year).