Search

Insurance Benefits Overview

See Overviews

A variety of insurance benefits can be set up in Open Dental to ensure accurate insurance estimates.

General Information

Benefits apply to all subscribers on an insurance plan. If different subscribers have different benefits, create different plans. If a user changes benefits for a plan, all Claim Procedures ( claimprocs ) estimates also change, including those on current and sent claims. Sent claims need to be recalculated before changes affect claim estimates.

Every benefit is stored as a row in the database. This format matches how electronic benefits from insurance companies are received.

Edit Benefits

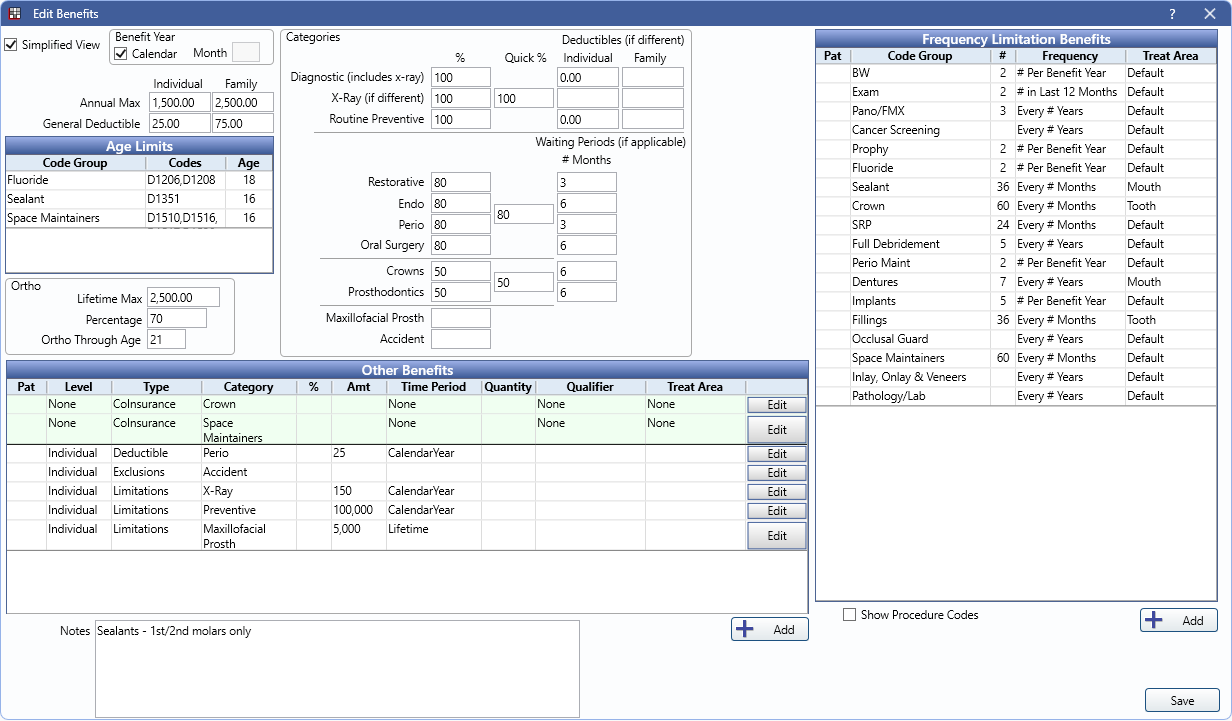

Insurance beenfits are set up in the In the Edit Benefits window.

Simplified View

In the default Simple View, preset categories for Age Limits, coverage percentage, and frequency limitations are available to quickly set up common benefits.

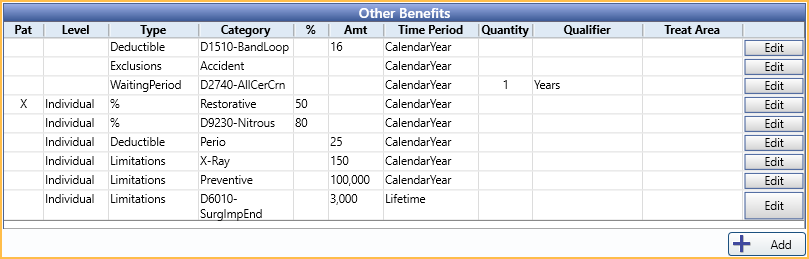

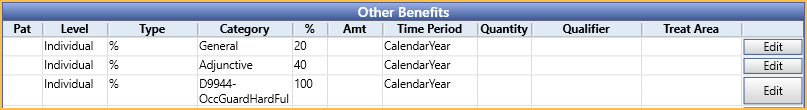

Other Benefits

Other Benefits can be set up to accomodate less common or more complex benefits, like percentage overrides, category maximums, exclusions, and more.

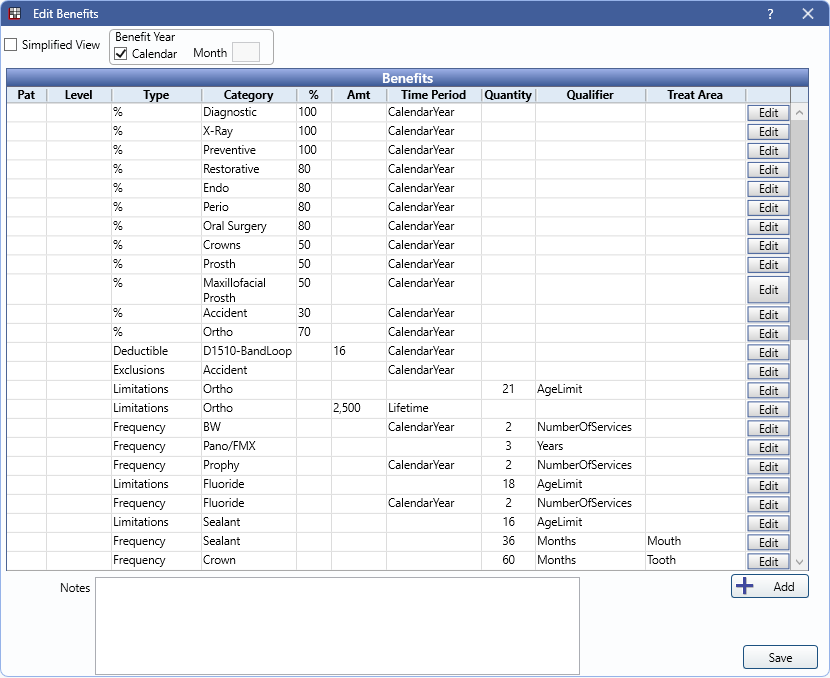

Row View

The Row View can be used if when typical benefit categories are not in use (e.g., outside of the US or Canada) to better accomate benefit setup. Simply uncheck Simplified View to use Row View instead.

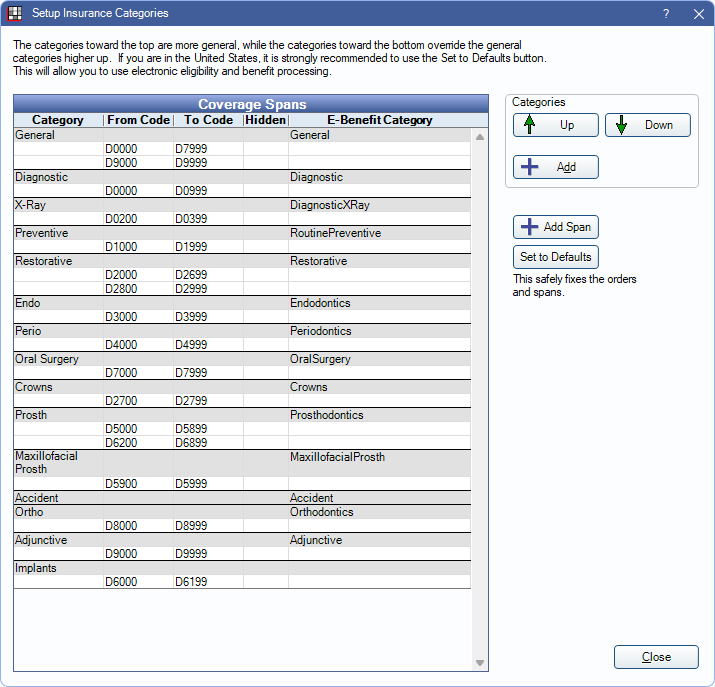

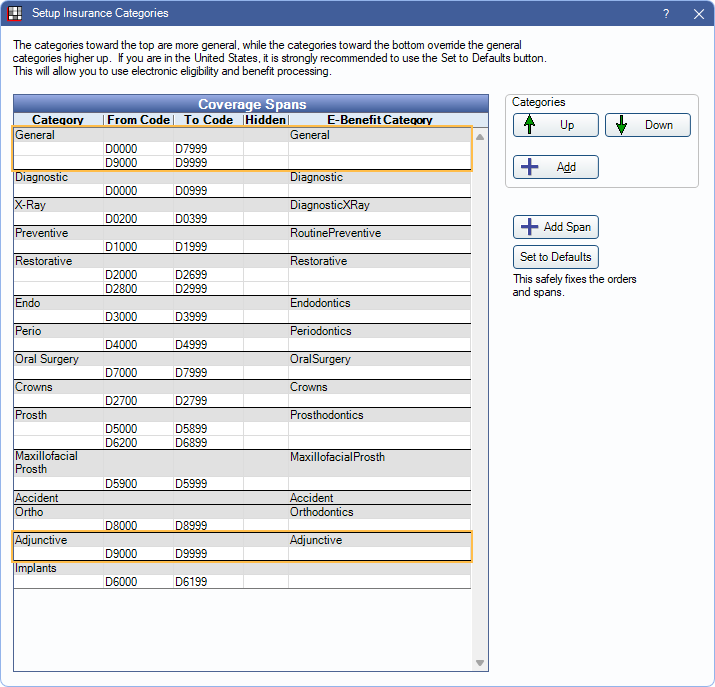

Insurance Categories

Insurance Categories are used for the default categories and benefit options in the Edit Benefits window. They can also be used when setting up Other Benefits. These are set up by default using typical code groupings. We do not generally recommend making changes to these categories.

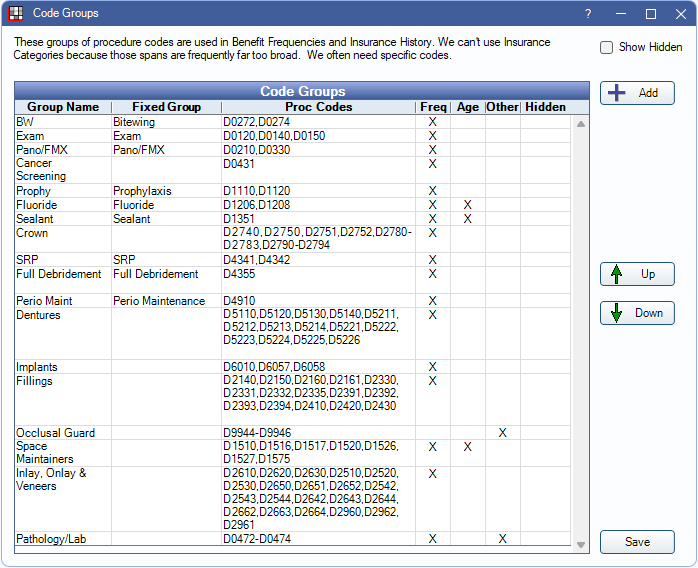

Code Groups

Code Groups are fully customizable groupings of procedure codes that can be used to set up Frequency Limitations, Age Limitations, and Other Benefits.

Code Groups can be set to show up in only specific areas, so you'll only see groups that are applicable to a certain beenfit type (e.g., a Bitewings category can be set to show in Frequency Limitations but not Age Limits).

Code Groups can also be confingured to determine which procedure codes are considered for Insurance History.

Insurance Benefits Logic

Complex logic is used when considering benefit setup and insurance calculations.

Deductibles

The deductible is applied before the insurance estimate is calculated. For example, if there is a $125 filling covered at 80% and the individual deductible is $50, the insurance estimate is $60 ($125 - $50 deductible x 80%) and the patient portion is $65 ($50 deductible + $15 amount left over after insurance). See Deductibles for detailed information.

Benefit Hierarchy

Benefits are calculated one procedure at a time. Multiple benefits can apply to a single procedure code. If some benefits are of the same type, there is a hierarchy to determine which benefits affect insurance estimates.

1. Benefits applied to the specific procedure code.

2. Benefits applied to an Insurance Category containing the procedure code. If the procedure is included in multiple categories, benefits for categories lower in the list take higher priority.

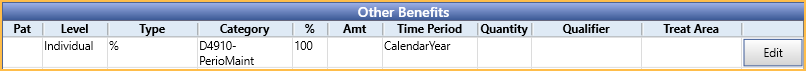

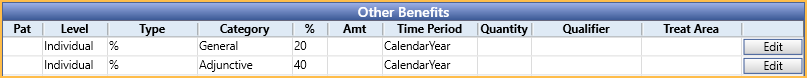

Example:

If D9944 is in both the General and Adjunctive insurance categories, the Adjunctive benefit supersedes the General benefit, because the category is more specific (lower in the Insurance Categories list). If no other benefits existed for the procedure, insurance would cover the procedure at 40% Perio rate, not the 20% General rate.

Because there is a benefit specifically for D9944, this supersedes the benefits for any category. Even though D9944 is included in the General and Adjunctive insurance categories, the procedure is actually covered at 100%.

Consideration of Other Procedures

Benefits are calculated one procedure at a time, but it may be necessary to consider benefits applied to other procedures. Time spans can be large, and information may be considered from multiple patients. For example, when calculating an ortho lifetime max, it is necessary to consider all procedures, regardless of treatment date, and a family annual max requires considering procedures from all patients under the same subscriber. When considering other procedures:

- Completed procedures attached to claims are always considered, regardless of if payment is received or still estimated.

- Treatment planned procedures are only considered when they are ordered before the current procedure. The order is as displayed in the Treatment Plan Module.

For Frequency Limitations, procedures affect frequency once attached to a claim. If the claim is denied (i.e., insurance pays $0), the procedure is no longer considered. If a claim is initially denied and a pending supplemental or supplemental payment is entered later, the procedure again affects Frequency Limitation. Dates entered into Insurance History are also considered. Completed procedures not attached to a claim are not considered.